Talabat’s Acquisition of InstaShop Signals Major eCommerce Shift

Talabat’s acquisition of InstaShop marks a defining moment for the MENA eCommerce market. The transaction, valued at $170 million, set a regional record and signaled a new phase of Talabat eCommerce Expansion. The sector’s rapid growth, driven by high smartphone adoption and digital innovation, now faces heightened competition and evolving consumer demands.

Metric | Value | Significance |

|---|---|---|

Acquisition Price (2015) | $170 million | Largest exit in the region at the time |

Market Size in 2024 | Reflects strong sector growth | |

Projected Market Size (2033) | $10,957 Billion | Indicates massive future potential |

Key Takeaways

Talabat’s purchase of InstaShop marks a major change in the MENA eCommerce market, showing strong growth and new opportunities.

The acquisition helps Talabat reach more customers, improve delivery speed, and use advanced technology to stay ahead of competitors.

Consumers enjoy faster delivery, better loyalty rewards, and more personalized shopping experiences after the merger.

Local businesses and entrepreneurs gain access to larger markets, better technology, and new chances to grow and create jobs.

This deal supports wider regional economic growth by encouraging innovation, investment, and digital transformation across MENA.

Market Shift

The acquisition of InstaShop by Talabat marks a turning point in the MENA eCommerce sector. The region is witnessing a rapid transformation as consumers move from traditional retail to digital platforms. Several factors drive this shift:

The MENA retail market is growing quickly, fueled by the rise of eCommerce.

Urbanization and a growing population expand the consumer base.

Technological advancements, such as digital payment systems, AI, and AR, change how people shop.

Disposable income is rising among the middle class, increasing demand for goods.

Social media and influencer marketing shape preferences, especially for younger buyers.

The COVID-19 pandemic accelerated online shopping adoption.

Retailers now focus on enhancing their online presence and offering personalized, culturally relevant products.

These trends show that the region’s eCommerce landscape is dynamic and evolving. Talabat eCommerce Expansion leverages these changes, positioning the company to meet new consumer expectations and outpace competitors.

Long-Term Effects

The long-term effects of this acquisition extend beyond immediate market gains. The MENA eCommerce market is projected to grow revenue by 18.3% in 2025, reaching nearly US$110 billion. This growth comes from increased internet access and smartphone use. Consumer preferences now favor personalized shopping, influenced by local brands and social media. Mobile payments are becoming more common, especially among younger people.

Macroeconomic initiatives, such as Saudi Arabia’s Vision 2030, support digital transformation and eCommerce growth. The expanding middle class continues to drive demand for online retail. New technologies, including AI and omnichannel retailing, improve customer engagement and efficiency. The shift from traditional to online retail, accelerated by the pandemic and better logistics, will likely continue. Companies that adapt quickly, like Talabat, will shape the future of the region’s digital economy.

Talabat eCommerce Expansion

Talabat Overview

Talabat stands as a leading force in the MENA region’s online food and grocery delivery sector. Founded in Kuwait, the company has expanded its reach to countries such as the UAE, Egypt, and Jordan. Talabat eCommerce Expansion has driven impressive growth, supported by a robust technology infrastructure and a dedicated delivery network. The company’s platform connects millions of users with thousands of restaurants and stores, offering a seamless ordering experience.

Talabat’s operational scale is evident in its 2023 performance:

Metric

Value

Gross Merchandise Value

Monthly Active Users

6 million

Active Partners

64,000

Active Delivery Drivers

115,000

Talabat eCommerce Expansion relies on a commission-based revenue model, charging restaurants 15-25% per order. The company also generates income from delivery fees and advertising. Its investment in technology ensures efficient order management and timely deliveries. Seasonal trends, such as the 25% drop in order volume during Ramadan followed by a 13% increase after, highlight the dynamic nature of the market. Talabat’s platform not only supports restaurants in reaching more customers but also creates significant employment opportunities.

InstaShop Overview

InstaShop, founded in 2015 in the UAE, has become a dominant player in the online grocery delivery market. The company operates a two-sided marketplace, connecting customers, stores, and delivery personnel. InstaShop’s business model focuses on convenience, offering an average delivery time of 45 minutes. The platform serves over 500,000 monthly active users across five countries, with a strong presence in the UAE.

Statistic/Metric | Value/Description |

|---|---|

Founded | 2015 |

Headquarters | Jumeirah Lakes Towers, UAE |

Sector | Online grocery delivery |

Monthly Active Users (2020) | 500,000+ |

Market Penetration | Leading in UAE |

Business Model | Two-sided marketplace |

Revenue Streams | Delivery fees, commissions, ads |

Talabat eCommerce Expansion benefits from InstaShop’s expertise in rapid delivery and its established customer base. InstaShop’s focus on technology and customer service aligns with Talabat’s strategy, strengthening the combined group’s position in the region’s eCommerce landscape.

Strategy and Impact

Expansion Drivers

Talabat’s acquisition of InstaShop reflects a deliberate strategy to capture the evolving needs of the MENA eCommerce market. The company identified several key drivers that shaped its expansion approach:

Affordability, variety, and high-quality cuisine motivate customers to order online.

Most customers place at least one order per month, with many ordering three or more times, showing strong demand.

Mobile devices serve as the main platform for placing orders, highlighting the importance of digital engagement.

Customer satisfaction links closely to professional delivery staff, food quality, and intuitive website design.

Timely delivery, while important, has a weaker impact on satisfaction compared to other factors.

Talabat eCommerce Expansion leverages these insights to refine its offerings and prioritize investments in technology, service quality, and user experience. The company’s focus on mobile-first solutions and diverse product selection aligns with the preferences of a digitally savvy, urban population. By understanding what drives frequent orders and loyalty, Talabat positions itself to sustain growth and adapt to changing consumer behaviors.

Competitive Edge

The acquisition of InstaShop provided Talabat with a significant competitive advantage in the regional eCommerce landscape. Several metrics highlight how this move strengthened the company’s market position:

Market penetration increased as Talabat gained direct access to InstaShop’s loyal customer base in the UAE and Egypt, accelerating its share of the market.

Last-mile delivery efficiency improved through the integration of InstaShop’s logistics with Talabat’s infrastructure, resulting in faster deliveries and higher customer satisfaction.

Technology and AI-driven integration enabled real-time tracking and optimized supply chain management, reducing operational costs.

Vendor and partner growth expanded as the merger created new cross-platform opportunities, boosting sales and brand exposure for small and medium-sized enterprises.

Revenue and gross merchandise value (GMV) grew, with Talabat’s grocery and retail GMV surpassing $2.5 billion, reinforcing its leadership in online grocery.

These competitive gains intensified the rivalry with established retailers and accelerated the adoption of digital grocery shopping across the MENA region. The combined strengths of Talabat and InstaShop set a new standard for operational excellence and customer-centric innovation.

Consumer Benefits

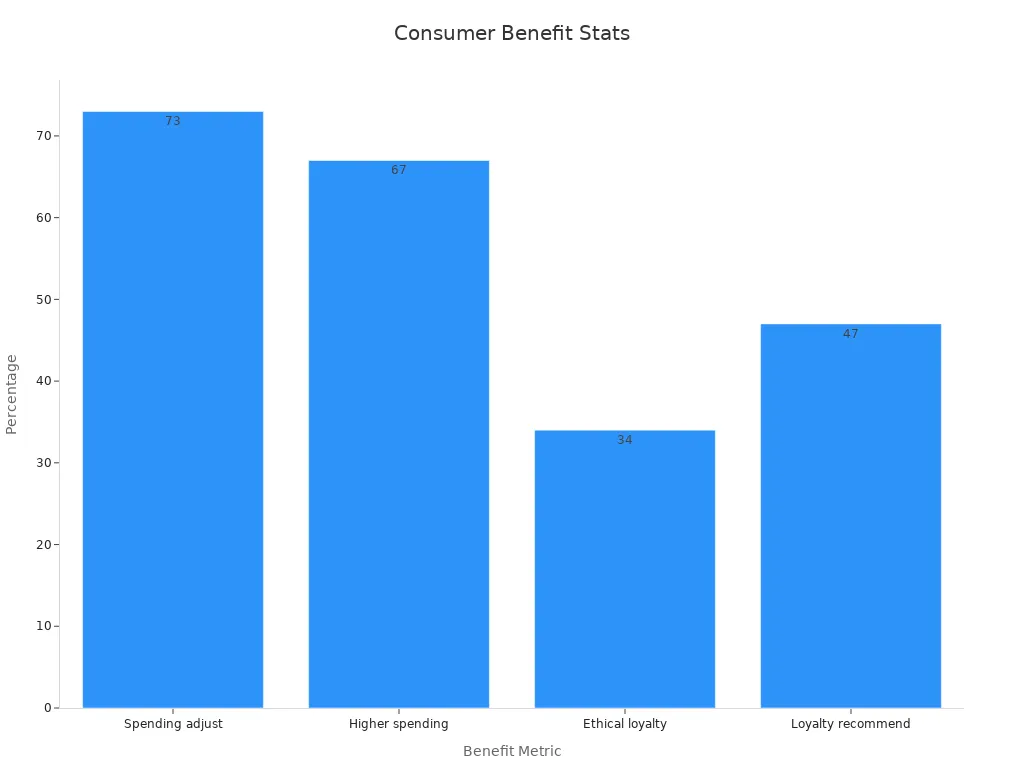

Consumers experienced tangible benefits following the acquisition, as reflected in recent statistical data:

Statistic Description | Consumer Benefit | Source |

|---|---|---|

90% of loyalty program owners see positive returns, averaging 4.8x their investment | Loyalty programs deliver strong value for participants | Antavo via Emarsys |

73% of consumers adjust spending to gain more loyalty benefits | Consumers actively maximize rewards | Bondbl via Emarsys |

Current customers spend 67% more on average than new customers | Increased engagement and value post-acquisition | Business.com via Emarsys |

Increasing customer retention by 5% increases profits by 25%-95% | Financial benefits linked to loyalty and retention | Bain & Company via Emarsys |

Loyal customers are 64% more likely to purchase frequently and 31% more willing to pay higher prices | Enhanced purchasing behavior and perceived value | McKinsey via Emarsys |

34% of consumers show true loyalty to ethical brands | Preference for brands aligning with consumer values | SAP Emarsys |

47% of consumers demonstrate loyalty by recommending brands | Satisfaction and advocacy | SAP Emarsys |

54% of customer-obsessed companies experience better loyalty and retention from omnichannel efforts | Benefits from consistent, personalized experiences | SAP Emarsys |

Consumers now enjoy more personalized experiences, improved loyalty rewards, and greater convenience. The integration of InstaShop’s rapid delivery model with Talabat’s technology platform has raised expectations for speed, reliability, and service quality. As a result, customer retention and satisfaction have increased, driving higher spending and deeper brand loyalty. The shift toward omnichannel engagement ensures that consumers receive consistent value, whether they shop online or through mobile apps.

Local Business Implications

Entrepreneur Opportunities

Talabat’s acquisition of InstaShop has opened new doors for entrepreneurs across the MENA region. Many local businesses now find it easier to access larger customer bases and new markets. The partnership between these two companies has created a ripple effect, encouraging startups and small enterprises to innovate and grow. Entrepreneurs benefit from increased exposure, improved logistics, and access to advanced technology platforms.

Description | How It Illustrates Opportunities Created by Acquisitions | |

|---|---|---|

Revenue Generated | Revenue resulting from partnerships | Shows direct financial growth and new revenue streams from acquisitions |

Customer Acquisition | Number of new customers gained through partnerships | Reflects expansion of customer base due to acquisition |

Conversion Rate | Percentage of partnership leads converting to paying customers | Indicates effectiveness of acquisition-driven partnerships |

Retention Rate | Rate at which customers acquired through partnerships remain loyal | Demonstrates long-term value and sustained opportunities from acquisitions |

Referral Metrics | Number of referrals or new leads generated via partnerships | Highlights extended market reach and new business opportunities |

User Growth & Engagement | Metrics like active users and growth rate | Shows adoption and market traction post-acquisition |

Funding Milestones | Progress in securing funding or partnerships | Validates growth potential and investor confidence linked to acquisitions |

Key Partnerships | Significant collaborations established | Illustrates strategic positioning and market expansion opportunities |

Business owners also see higher survival rates and job creation. Many report increased household income and more active participation in the digital economy. The acquisition has inspired a new wave of business registrations and partnerships, fueling a vibrant entrepreneurial ecosystem.

Regional Growth

The acquisition’s impact extends beyond individual businesses, driving broader regional economic growth. Several trends highlight this transformation:

Over 66% of businesses pursue mergers and acquisitions to boost market share, showing a direct link to regional dominance.

Nearly 88% of companies identify access to new markets as a key benefit, while 83% observe increased revenue after acquisitions.

The technology sector saw a 16% rise in M&A activity in 2024, fueled by investments in AI and digital transformation.

Deal values above $25 million grew by 12% to $3.4 trillion, with an 8% increase in the number of transactions, signaling robust investment activity.

Midsize deals now account for almost half of global M&A activity, supporting economic expansion.

More than half of CEOs focus on innovation through acquisitions, driving competitive advantage and regional development.

Corporations and private equity firms increasingly prioritize cross-border deals and advanced analytics, strengthening market expansion and supply chain resilience.

The combined strength of Talabat and InstaShop sets a powerful example for the region. Their success demonstrates how strategic acquisitions can fuel innovation, create jobs, and support sustainable economic growth across the MENA region.

Talabat’s acquisition of InstaShop has accelerated digital transformation in the MENA region. The move mirrors global trends, where markets like Latin America and the Philippines show double-digit eCommerce growth.

Region | Trend/Statistic | Impact |

|---|---|---|

LATAM | Expanding market size | |

Philippines | 24.1% sales growth in 2023 | Rapid market expansion |

United States | 42% plan to spend more online in 2024 | Rising consumer demand |

Global B2C | $4.8T to $9T by 2032 | Massive expansion potential |

This shift creates new opportunities for innovation and business growth. Consumers benefit from better service and more choices. Companies must adapt quickly to stay competitive in this evolving landscape.